World Energy Congress Istanbul

The world will find it difficult to meet the 2°C target set in the Paris Agreement unless it goes down a path of strong enforcement by national governments of international agreements to curb greenhouse gas emissions. That’s one of the key conclusions of the World Energy Scenarios 2016 report from the World Energy Council, which looks at how global trends will shape the energy industry over the next 45 years. The report was launched today at the World Energy Congress in Istanbul.

“One of the big messages of the Scenarios is that if the commitment is there, the ambitions of COP21 can be achieved.” This is how Ged Davis, the Executive Chair of the team producing the scenarios, sums up what is perhaps the most important message to come out of the flagship publication just published by the World Energy Council.

The World Energy Scenarios represents the fruit of three years’ work by the World Energy Council (WEC) with feedback from experts from all over the world and modelling by the Paul Scherrer Institute and Accenture. Rather than outlining for policymakers and senior energy leaders how to achieve specific policy goals, the Scenarios allow them to evaluate key factors and their consequences, to better shape tomorrow’s energy world. The 2016 version, just published, offers three alternate pathways up to the year 2060, and is meant to be considered alongside other important WEC reports on World Energy Issues, Resources and the Energy Trilemma.

“There are no easy solutions”

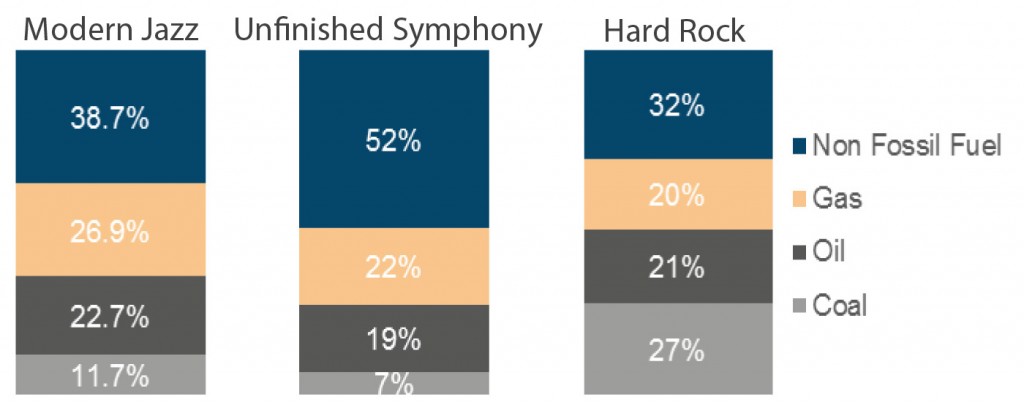

The three different futures are dubbed Modern Jazz, Unfinished Symphony and Hard Rock. All three assume certain common factors such as population rise, slower labour force growth and the gradual shift of the balance of the world’s economy to Asia, but from then on they diverge:

- Modern Jazz is a future where enterprises are able to innovate and compete, in open markets, and supply low-cost energy for all.

- Unfinished Symphony foresees a world where international agreements and national policies prevail and determine choices, but energy costs are high and there is still more work to be done.

- Hard Rock is what we might see if nations have slower growth and become more conservative and less outward looking as a result of conflict, environmental chaos and migration crises.

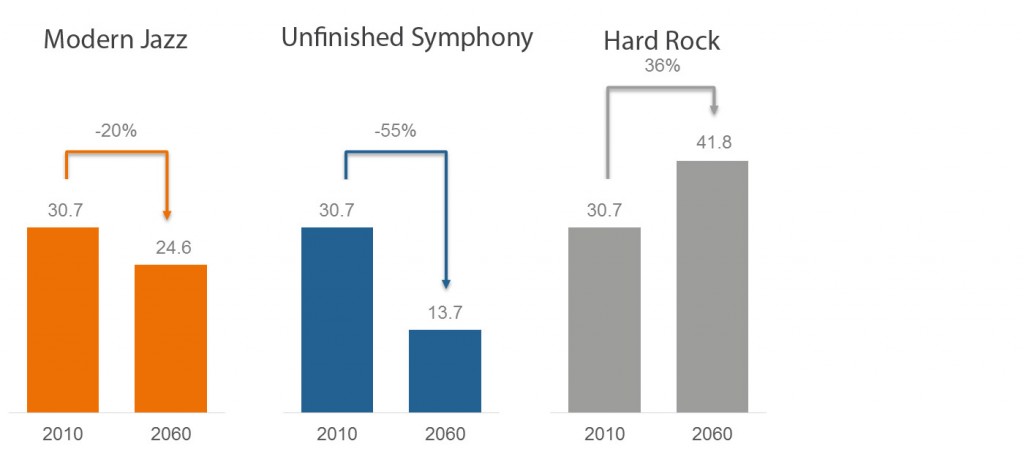

Figure 1. Carbon emissions in 2010 and 2060 (GtCO2/yr). The greatest drop is in Unfinished Symphony – but even then it doesn’t quite result in 2oC.

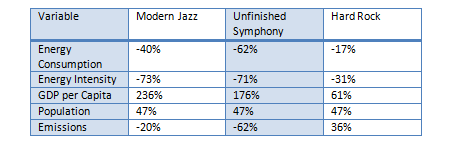

Only in the Unfinished Symphony scenario is total energy consumption – and energy intensity – reduced sufficiently to give us a chance of getting near the 2°C target. It does this by reducing carbon emissions at rate of -1.6% per year, and that is difficult. Hard Rock, on the other hand, gets us to about 4oC. Modern Jazz lands us in the middle.

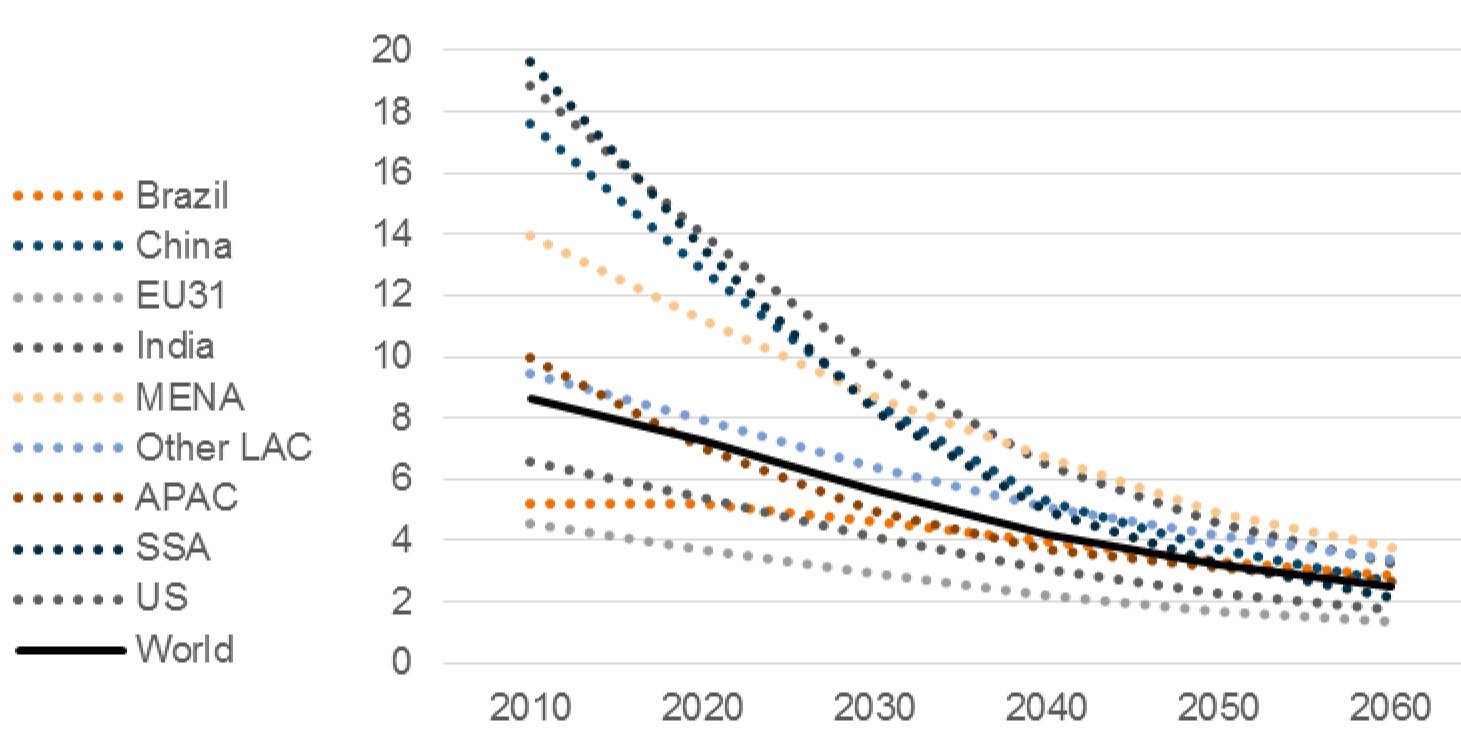

Figure 2: Global Energy Intensity reduction in Unfinished Symphony 2010 to 2060 (MJ per USD 2010 MER).

“In Modern Jazz, if you don’t have strong carbon prices it slows down the migration to a low carbon economy,” says Davis, “whereas in Unfinished Symphony governments enable relatively high carbon prices which accelerates decarbonisation.”

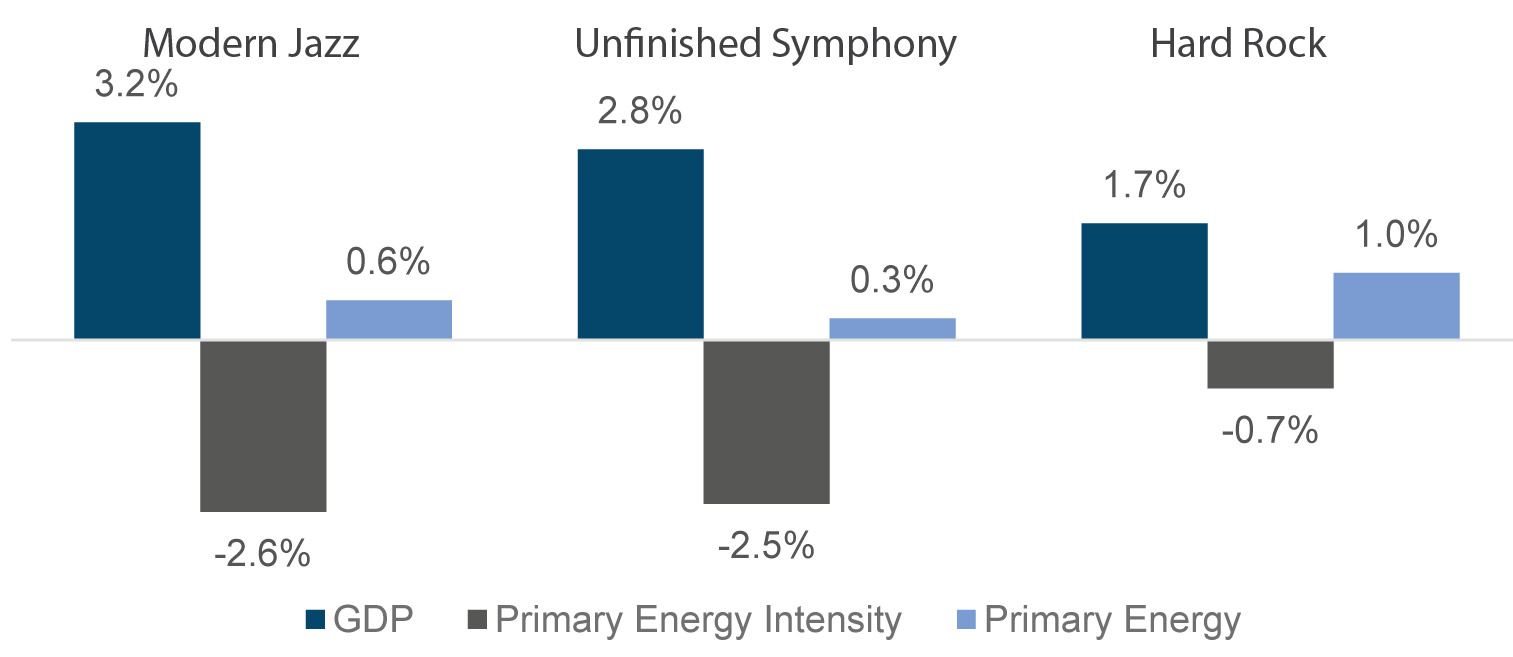

But there is a price for living in a strongly regulated world, and that is the restriction on private enterprise to innovate and compete on its own terms. In the Modern Jazz scenario higher productivity rates lead to higher GDP per capita and lower prices, and thus a greater proportion of the world’s people have access to clean water and electricity at affordable prices.

In the third, contrasting scenario – Hard Rock – the world’s economic growth is weaker and the world is subject to various crises, countries retrench and progress is slow on decarbonisation and addressing wider issues besides jobs, conflict management and migration control. GDP is much lower and there is much greater use of fossil fuels because there is less funding available to invest in low carbon infrastructure.

Figure 3: GDP, energy intensity and primary energy growth to 2060 in the three scenarios.

Intelligent economies

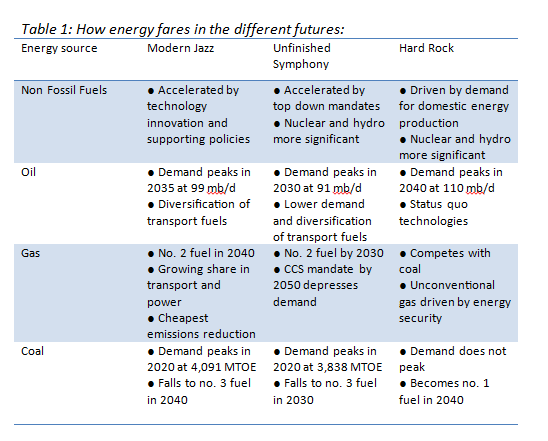

In the policy-led world of Unfinished Symphony, carbon pricing helps to dampen energy demand growth, to reach the lowest energy use per capita, and total primary energy supply is just 17% higher than in 2010. The share of fossil fuels falls to 48% and the rich-poor gap decreases because of greater emphasis on social, environmental and security issues.

Strong global governance leads to the design of intelligent and circular economies, resulting in a resilient, integrated global energy system. Yokohama Smart City is given as a good example of how integrated, smart planning can deliver a high standard of living more efficiently and with less pollution.

Nuclear power grows at 2.1% p.a. to 18%. Just 200-500 million people have no access to electricity. Electrification of mass transit happens in the world’s largest cities, and by 2030, most developed countries have coal plants retrofitted with CC(U)S technology, as do natural gas plants after 2050.

Table 1: How energy fares in the different futures:

Smartly connected

In enterprise-led Modern Jazz, the rich-poor gap widens but average GDP per capita is higher than in Unfinished Symphony, and there is the highest energy and electricity use per capita. Although most people have access to water, millions are forced to migrate.

Globalisation and technology transfer lead to more efficient industrial activity and a convergence of energy intensities across the world. Natural gas and electric vehicles power transport in heavy freight and shipping. All homes, offices and commercial spaces are smartly connected and more energy efficient, and energy systems are distributed. Natural gas is used widely as a chemical feedstock.

“Unless we can find ways to double the rate of decline in energy intensity we have a real problem”

By 2030, there are over 185 million electric and hybrid vehicles on the roads, rising to 1.5 billion by 2060. The use of gasoline peaks in 2050 and diesel fuel peaks in 2040. But a decline in coal consumption in North America, Europe and China is offset by growth in India and Pacific Asia.

Natural gas does pretty well in both the enterprise-led future and the government-led one, although it starts to decline a decade earlier without a free market. Coal fades out even earlier. In the more dystopian Hard Rock future, coal remains king up to 2060 and demand for it never peaks as more and more coal-fired power stations are built to fuel growth.

Figure 4: The energy mix in 2060 under different scenarios.

Table 2: The scenarios use a formula to derive final carbon emissions from the following variables: energy consumption, energy intensity, GDP/capita and population. This table shows the percentage change in these from 2010 to 2060 and their effect on emissions. Unfinished Symphony produces by far the greatest drop but Modern Jazz is more productive.

The biggest challenge

The process of creating the scenarios involved many participants from around the world: besides China, Europe, North America, workshops were held in Latin America, India and Africa. “We are working with partners Accenture Strategy and the Paul Scherer Institute, and have shared our work with the Energy Research Institute in China. The important issue, particularly for climate change, is what Indonesia, Australia, China, India will do. If you are in China and India – Africa even more – there is great potential to improve productivity through catch-up, the ability to use best practices and technology from around the world. There is still much to do in Europe to improve productivity.”

The biggest challenge of the future in all scenarios is the potential slowdown in economic growth, Davis believes. “If we look back 45 years we’ve had exceptional economic growth of 3.5% per year, pretty much evenly split between productivity and labour force. In the next 45 years labour force growth will reduce to 0.7% or less. The slowdown in productivity means a re-emphasis on where growth is, and it will be challenging to address this.”

By 2030, there are over 185 million electric and hybrid vehicles on the roads, rising to 1.5 billion by 2060

One finding is that the changing nature of work and technology will have a big effect. Davis: “The problem we have is that the more productive a nation is the less jobs needed, so there is a big need to continually retrain the workforce into new areas. The challenge in Hard Rock is about addressing this productivity paradox in a world in which the political and economic centre of gravity is shifting. This will present a potent cocktail in some places.”

Major shifts

Other major shifts will have a powerful effect on our future, Davis notes. These are “a shift in the world’s economic centre of gravity to Asia, wider environmental concerns, population growth and climate change – which, when it hits, doesn’t treat everyone equally. So we have built into our scenarios the early results of the World Energy Council’s resilience analysis including the need for greater adaptation. Also deeper analysis on planetary boundaries. Furthermore, globalisation doesn’t work for everyone, so there is a lot of anger about the fairness of the economic system. We tried to understand the implications of this for energy security.”

In Modern Jazz and Unfinished Symphony radical improvements in energy efficiency and a shift towards a less energy-intensive economy play a big role. “Unless we can find ways to double the rate of decline in energy intensity we have a real problem.”

There’s another important shift, which we can see happening now, and it is a shift in values. The new generation of “millennials” may care more about wider social, environmental and political issues than the previous “baby boomer” generation. “These new values, if they persist, will reshape the nature of how we address large-scale economic and post-industrial development,” says Davis. “There are no easy solutions. We inherit the capital stock of the last 50 years and ideally we need new capital stock to reflect these new values. It is a question of the desire, and of capacity.”

“Of course, there will always be some companies that are backward, just as some countries are”

Davis himself says that he would like to see Modern Jazz work, while admitting that stronger incentives will be needed to bring about the necessary changes. So does he believe the desire is there in the corporate world to make the required energy transition? “I come from 30 years of working in Shell. I know that energy companies spend a lot of time anticipating what their customers want up to 20 years ahead and investing to deliver that.”

But pressure still has to come from outside. “There are many ways to influence policy and activist groups are definitely important in that respect. Of course, there will always be some companies that are backward, just as some countries are. Some are progressive and some have much to learn.”

The Scenarios offer an opportunity for decision-makers to reconsider potential strategies and policies in an uncertain world. “The starting point for building our scenarios was to identify what is possible and feasible.” says Davis. “Our greatest challenge is how well we can work together to tackle problems relevant to all.”