|

| Reviews and Templates for Expression We |

Why sustainability makes business sense in 6 survey findings

A global view of corporate social responsibility (CSR)

More businesses than ever are contributing to the greater good across the world, according to the most recent Grant Thornton International Business Report. The survey asked what companies are doing to make their operations more sustainable and why. Here are some of the top findings:

• Cost management emerges as the key driver for CSR, followed by customer demand and because it’s the ‘right thing to do’.

• How a business is perceived to be operating is also important, especially in China.

• Vast majority of businesses are involved with local charities, either through donating time, money or products/services.

• Businesses are working to reduce their environmental impact, with increasing numbers calculating the carbon footprint of their operations.

• More than half of businesses now view integrated reporting as best practice.

Survey finding No. 1: Sustainability is a priority, yet a challenge to implement

“Sustainability is top of mind for nearly all companies, but they pursue it to varying degrees,” says Tony Perazzo, Grant Thornton LLP Audit partner. “For most, it starts with the customer. They feel good knowing that they have made a responsible purchase. And many will choose an eco-friendly product or brand even if it is a little more expensive than an alternative.”

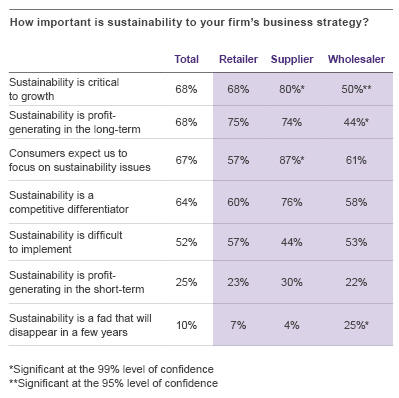

Our survey confirms that: Forty-four percent of respondents rated sustainability as being extremely important or important in their company’s business strategy. Nearly seven in 10 said sustainability is critical to growth (68%), profitable in the long run (68%), expected by customers (67%) and a competitive differentiator (64%).

Sustainability benefits aside, one in two companies believe that it is difficult to implement (52%). This is not surprising, says Dexter Manning, Food and Beverage practice leader: “Most middle-market companies are just beginning their sustainability journey. They are approaching sustainability as a means to reduce costs and improve processes. Companies are looking to see if they can become more energy-efficient, reduce waste and use more environmentally friendly packaging.”

Why it works: Sustainability is profitable

A study published by Harvard Business School in July 2013 found companies that embraced a long-term corporate culture of sustainability outperformed their peers in terms of reputation, net income and stock price.1 Even while sustainability may be hard to implement, those companies that are doing so see strong ROI.

For instance, Kroger tested and adopted hydrogen fuel cells to power material-handling fleets at its Compton, Calif., distribution center, which supplies groceries for Ralph’s supermarkets. The site has thus far experienced decreased maintenance costs and an ROI of approximately 20%. And since fuel cells emit only a small amount of heat and water, the forklift-generated carbon footprint (pollution) at the site is virtually eliminated, thereby meeting Kroger’s goal of achieving sustainability in its operations.2

Ocean Spray and Tropicana also recently partnered to help reduce their carbon footprint from transportation. Ocean Spray saved over 40% in transportation costs compared to its previous trucking method, and reduced greenhouse gas (GHG) emissions by 65%. Tropicana was able to eliminate most of the costs and GHG emissions of the boxcars’ return trip, though it had to undergo a number of business process changes.3

Companies pursue sustainability for a host of reasons. “For many companies, it’s about becoming more efficient and driving ROI,” Perazzo notes. “For others, the driving force is the passion and belief that they are doing the right thing. In either case, companies realize their consumers expect it and care about what’s in the product and how it’s made and delivered to them. In the end, companies are realizing that sustainable practices can increase efficiencies and reduce costs to even greater extents than they had anticipated.”

Food and beverage industry is particularly sensitive to sustainability issues

Sustainability is about risk. Damaging the environment and climate change lead to increased business risks, affecting corporate value chains. Environmental threats can result in cascading risks. When a drought in the Midwest affected grain production, Archer Daniels Midland’s earnings fell by 21% year-over-year in the second quarter of 2013.4 Anheuser-Busch, the world’s largest beer brewer, was hit hard in 2001 when a drought in the Pacific Northwest severely affected its operations. The price of barley skyrocketed, and the availability of aluminum for cans dropped as smelters reduced output due to rising electricity prices.5 Food and beverage companies are extremely vulnerable to these cascading risks.

“The food and beverage industry operates at the intersection of food, water and energy,” Manning says. “All of those are governed by regulations. All are vulnerable to our climate. Companies’ results hinge in part on whether there have been good climatic conditions for their ingredients.” Survey finding No. 2: Different role in the supply chain, different attitude toward sustainability

Interestingly, there are significant differences between business types and how they prioritize sustainability initiatives. For example, retailers, especially grocery/supermarket/supercenter and specialty retailers, were more likely to reduce energy consumption. Grocery/supermarket/supercenter retailers were more likely to pursue paper and packaging recycling. Suppliers were more likely than others to reduce production waste. Wholesalers, who rarely sell directly to consumers, were the least likely to engage in sustainability activities and were significantly less likely than others to reduce energy consumption and fund social programs. In fact, wholesalers were the most likely to say that sustainability is a fad that will disappear in a few years (25% of wholesalers vs. 7% of retailers and 4% of suppliers.)

“The differences between the various players in the supply chain are not that surprising,” Manning notes. “Most sustainability programs start with pressure from stakeholders — consumers, stockholders or governmental bodies,” he says, adding that wholesalers and distributors are much less in the public eye and consequently are under less pressure to incorporate sustainability measures.

How it works: Embed sustainability into organizational culture

A lot of businesses pay lip service to sustainability, but fewer take real and consistent action. Moreover, those who primarily talk about sustainability versus those that genuinely pursue sustainability differ by industry. According to the 2013 MIT Sloan Management Review and Boston Consulting Group sustainability survey results, industries that contend with resource scarcity and high energy costs take sustainability most seriously. These include food and beverage companies that need resources for ingredients, energy and utility providers, chemical producers, and industrial and machinery retailers.

Survey finding No. 3: Leadership commitment, ROI key to successful sustainability programs

A number of factors are critical when considering and planning sustainability programs. The most widely noted include support from the C-suite, a focus on profitability and measurable performance targets.

Commitment from the top. Regardless of who owns sustainability within the organization, it’s critical to have support from the organization’s leadership. A successful sustainability initiative starts with involvement of the C-suite and key stakeholders, all voicing a strong commitment to sustainability’s benefits for the business.

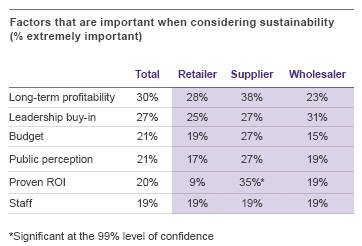

According to Grant Thornton’s survey respondents, leadership buy-in (27%) is one of the top two factors (profitability is the first) for companies when considering a shift to sustainable practices.

Focus on profit. If sustainability is going to succeed, companies need to make the clear case for its long-term profitability. Grant Thornton’s survey found that long-term profitability (30% say this is extremely important) was the most important factor in the success of sustainability programs. Budget, public perception, proven ROI and staff are considered extremely important factors by 20% of respondents.

Perazzo says: “Take product packaging. Often the focus is on recycling, as well as how much material you are using. If you’re creating less waste by being innovative in packaging, consumers will take notice. Since producing lighter packaging saves money, these types of initiatives are more likely to be accepted by leadership.”

Attention to risk. Another important consideration is the organization’s overall risk profile and how sustainability can affect it. Companies need to be evaluating sustainability from a holistic, risk-based approach, asking questions such as: If I change suppliers, am I moving to a supplier with less financial stability, or one operating in a country with less geopolitical stability? “Whenever you adopt changes for sustainability purposes, you have to make sure stakeholders are on board and that the company considers changes to its risk profile,” Manning says.

Survey finding No. 4: Metrics vary considerably

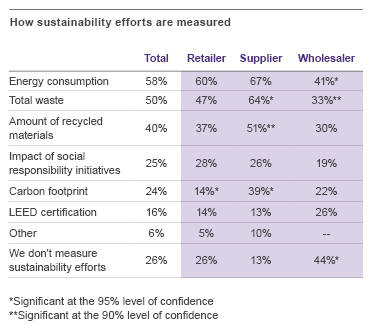

According to Grant Thornton’s survey, 74% of respondents reported that their company measured sustainability efforts. Energy consumption (58%), total waste (50%) and amount of recycled materials (40%) were the most frequently mentioned ways of measuring sustainability efforts.

Measurement is critical to track the company’s progress, Perazzo says. “Since so much of the motivation for sustainability is driven by improving profitability and customer perception, companies will want to closely track and measure these efforts so they can report back to their stakeholders and customers alike.”

Having measurable performance goals and targets is important, yet companies have a large choice of options — literally hundreds — when it comes to sustainability practices used and metrics reported. Companies often struggle in determining which topics and specific measures are material to their organization and what meets their stakeholder expectations. The large number of metrics can also complicate the development of a set of reporting standards broadly applicable across companies, which makes peer group benchmarking difficult.

The best way to select metrics is to begin with corporate goal-setting. Once the goals are in place, identify the measures or metrics that relate to each one. This is important before establishing the information systems requirements for tracking the selected metrics. These information systems, combined with processes and internal controls, are vital to the credibility of the sustainability data and information reported.

“If companies fail to establish tangible performance goals and don’t select the right metrics, reporting meaningful ROI to stakeholders will be a significant challenge. Without such strategic rigor, what can develop are efforts that dilute the benefits to the company and the environmental impact,” Perazzo cautions.

Why it works: Reporting frameworks can be a measure of your success

Some frameworks are for specific areas of interest, such as the Carbon Disclosure Project (CDP) for GHG emissions and industry-specific reporting standards issued by the Sustainability Accounting Standards Board. Others are broader regimes, with a more comprehensive, holistic approach, such as the new International Integrated Reporting Council’s Integrated Reporting Framework and the well-established Global Reporting Initiative (GRI).

Many large companies use the metrics suggested by frameworks such as the CDP, the GRI and the Dow Jones Sustainability Index. The GRI maintains one of the most comprehensive online global databases of organizations' sustainability reports and allows stakeholders to view them without charge.6

More than 350 Fortune 500 companies participate in the CDP. Many reporting to the CDP don’t have a regulatory mandate to do so, but participate voluntarily. Many perceive that participation identifies them as companies that take measurement and reporting seriously and demonstrates that they follow a sustainability business model or that sustainability is an important element of their business strategy. Moreover, a growing number of investors and vendors request reporting on carbon emissions.

Survey finding No. 5: Incentives can offset costs for companies

Federal and state governments continue to offer tax credits and incentives for businesses pursuing sustainability initiatives, notes Tim Schram, managing director of Grant Thornton’s state and local tax services.

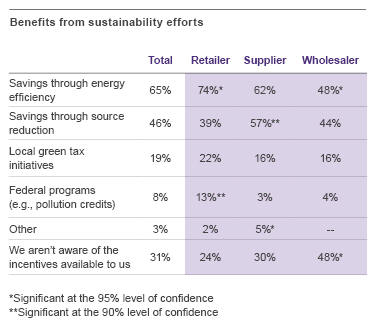

While survey respondents take advantage of some credits and incentives, there continue to be missed opportunities. Sixty-five percent reported that their company’s sustainability efforts benefited from savings through energy efficiency and 46% reported savings through source reduction. Nearly one in five (19%) reported saving through local green tax incentives and 8% through federal programs. At the same time, 31% of survey respondents were unaware of credit and incentive opportunities. Wholesalers, especially, are largely uninformed about them (48%).

“Incentives such as discretionary cash grants, state and local incentives, and federal tax credits can offset sustainability investments, making them even more attractive. By taking advantage of the numerous green credit opportunities, businesses can offset costs and improve ROI. For companies looking to grow and cut costs, this is a great time to invest in capital projects that foster sustainability,” Schram says.

Survey finding No. 6: Sustainability focus and progress depend on supply chain role

An interesting survey finding is that food and beverage suppliers, wholesalers and retailers, differ widely in their priorities and activities concerning sustainability. Suppliers and manufacturers, because of their focus on production and, consequently, the high amount of energy used, have historically been more involved in sustainability efforts. With the largest potential savings, it makes sense that they are the strongest adopters. Their early involvement has put them ahead of the curve, and their higher public profile puts them under scrutiny of political and consumer groups.

“There is ROI to consider, and the bigger ROI is going to be in the manufacturing and food processing part of the supply chain, as well as in retail, particularly with regard to recycling and packaging,” Manning says.

Suppliers are significantly more advanced than retailers and wholesalers in their sustainability activities. This is not surprising, given that manufacturing processes were an early target for sustainability efforts. Suppliers are more likely to say that sustainability is critical to growth (80% of suppliers vs. 68% of retailers and 50% of wholesalers) and that their customers expect a sustainability focus and that ROI is important when considering sustainability. Additionally, suppliers are more likely than retailers and wholesalers to pursue reducing production waste. Suppliers also are significantly more likely than retailers and wholesalers to measure sustainability efforts (87% of suppliers vs. 74% of retailers and 56% of wholesalers). They are also more likely to measure total waste, the amount of recycled materials and their carbon footprint.

The good news is that food and beverage retailers are starting to catch up to suppliers in the area of sustainability. One challenge for retailers is that they have fewer resources to be as aggressive in these efforts because they work on slimmer margins. One area in which they stand out is energy consumption. These types of retailers are more likely than suppliers and wholesalers to pursue reducing energy consumption (78% of retailer vs. 62% of suppliers and 47% of wholesalers).

Wholesalers/distributors/brokers appear to fly under the radar when it comes to sustainability efforts. Perhaps, as middle men, they are not subjected to public and political scrutiny in the same way that manufacturers and retailers are, and so are not as pressured to make advances in sustainability, particularly those that require investment.

The primary cost in wholesale distribution is transportation. How do you move product? How far does it have to go? Can you use cleaner, more sustainable fuel sources? The question for many companies is whether or not there’s sufficient ROI to make those types of changes work, Manning says.

Wholesalers/distributors/brokers were the least likely to pursue sustainability. Thirty-one percent of wholesalers have no sustainability initiatives, compared with 10% of retailers and 4% of suppliers. Wholesalers were also significantly less likely to pursue reducing energy consumption and funding social programs (16% of wholesalers vs. 32% of retailers and 40% of suppliers).

ROI of sustainability initiatives includes profits and public approval

Middle-market companies that aren’t already actively addressing sustainability should be asking: How do I reduce costs and safeguard environmental resources and create sustainable business practices?

“A perfect starting point is to tie the investment to a cost-savings program, whether that’s to redesign packaging to reduce material usage, which will save money and reduce landfill, or to reduce energy usage by investing in energy-efficient equipment,” Manning says.

And perhaps most important: “Customers want to know where and how their food is grown, and what the company is doing in the process of getting the food to shelf,” Perazzo says. “This is more important than ever. Managing sustainability costs and ROI can lead to significant growth opportunities.”

|

|

|

|

Copyright 2011 Energy and Technical Services Ltd. All Rights Reserved. Energyts.com |