|

| Reviews and Templates for Expression We |

Investors View Climate Change as ‘Material Risk’

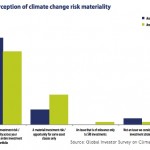

A majority of investors view climate change as a material risk and as a consequence have retained — and in many cases advanced — their commitment to addressing climate change in their investment activities, according to research by consultant Mercer.

A majority of investors view climate change as a material risk and as a consequence have retained — and in many cases advanced — their commitment to addressing climate change in their investment activities, according to research by consultant Mercer.This is despite wider economic challenges and continuing policy uncertainty, according to the third annual Global Investor Survey on Climate Change. There is a “clear trend” in the results showing that climate risk analysis is performed within asset classes and for specific investments rather than at the portfolio level. In equity portfolios, for example, an analysis of climate risk was performed by almost all respondents, according to the report.

The report was published by the European Institutional Investors Group on Climate Change, the North American Investor Network on Climate Risk, the Australia/New Zealand Investor Group on Climate Change and the Asia Investor Group on Climate Change.

Assessments of climate risk are directly influencing investment decisions, the report says. Fifty-three percent of asset managers said that they decided to divest or not invest in listed equities based on climate change concerns, and a majority of asset owners — 69 percent — said that climate change integration influenced their fund manager decisions in 2012. This was a marked increased on the 43 percent who declared the same last year.

An increasing number of asset owners — 63 percent — also said they are monitoring their existing asset managers on how they integrate climate change into their investment processes. This is a 10 percent increase on last year. A majority have conducted formal or informal climate risk assessments of their portfolios, the report says.

Despite encouraging signs of progress in the assessment of both low carbon and emission intensive exposures, investors face a number of challenges. These include a lack of clarity on which investments should be measured, patchy carbon signals, limited data — particularly for fixed interest investments — and inadequate company disclosures, the report says.

The survey is based on responses from 37 asset owners and 47 asset managers with collective assets totaling more than $14 trillion.

Climate change and the strain it puts on natural resources could effectively “wipe out” assets in pension pots and reduce pensions to negligible levels, according to a report released last month by the Global Sustainability Institute at Anglia Ruskin University.

|

|

|

|

Copyright 2011 Energy and Technical Services Ltd. All Rights Reserved. Energyts.com |