|

| Reviews and Templates for Expression We |

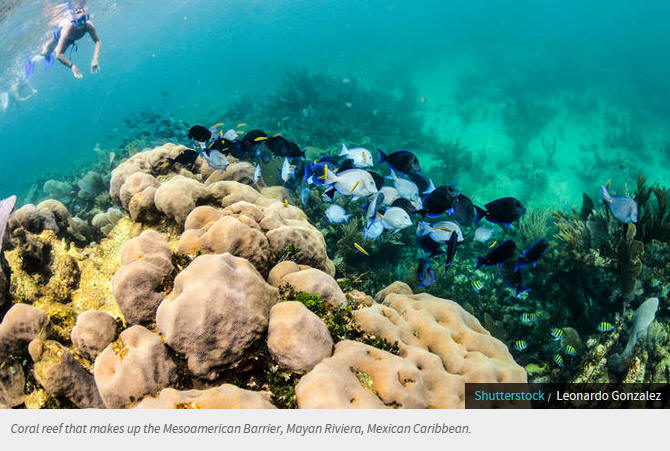

Cancun's coral reef receives a health insurance policy

You likely use life, health and auto insurance — but what about reef insurance? A 40-mile stretch of the Mesoamerican coral reef off the coast of Cancun, Mexico, soon will be the first in the world with its own insurance policy, piloted by the Nature Conservancy (TNC) and reinsurer Swiss Re AG, which helps protect it and surrounding businesses from climate change-related damage.

The policyholders are the local beachfront hotels and tourism organizations in Cancun and Puerto Morelos, Mexico, that are dependent upon the reef for tourism dollars and storm protection. They will pay policy premiums feeding into the government-monitored Reef & Beach Resilience and Insurance fund and receive reimbursements to repair the reef and beaches when they are damaged by storms and other natural disasters.

The collective pot of insurance premiums is between $1 million and $7 million, reported the Guardian, and the insurance payout will be between $25 million and $70 million per year. Insurance policies are being activated in September, with full coverage beginning in January.

"It is a parametric insurance policy, which uses a physical characteristic of the event [like waves or rainfall] as a proxy for when that insurance money would be released," Alex Kaplan, head of global partnerships, Swiss Re North America, who helped spearhead the policy. "The innovation here isn’t necessarily the insurance mechanism itself, but the idea that you are insuring something that no one actually owns" and that protects the valuable assets standing behind it.

Quantifying coral

Coral reefs are more than beautiful structures: They are essential for ecosystem health and act as natural guardians of the coastline. Reefs act as a speed bump for slowing storm damage, reducing up to 97 percent of a wave’s energy; losing just 1 meter of reef height can lead to twice the amount of damage onshore. Since 840 million people worldwide live with the risk for coastal flooding, coastbound communities can’t afford not to keep reefs healthy — when Hurricane Wilma struck in 2005, it caused $7.5 billion of damage in Mexico.

Diving further, a study authored by TNC scientists for the Journal of Marine Policy found that 1 square kilometer of reef protects up to $6 billion in built capital from flooding. Creating artificial breakwater isn’t as effective as reef, and construction costs are 15 times higher than reef restoration. Human-built infrastructure also fades over time, while self-repairing "green infrastructure" appreciates in value as it grows.

Furthermore, "you don’t think about a family packing up to go snorkeling on a seawall," said Kathy Baughman McLeod, TNC’s managing director of coastal risk and investment. "If you protect these natural assets, you also get improvement of fishery health, water quality and coastal ecosystems and how they store carbon in their salt-soaked soils."

Finding efficient, science- and data-driven investment to boost nature’s resilience is where private capital comes in, especially when it works side-by-side with government initiatives.

"The fundamental question is what are you doing on the ground that leads to the result you want? Once you can quantify that, you can supply it — that’s what the private sector is good at," said Adam Davis, managing partner of Ecosystem Investment Partners, a private investment money manager.

He cited Louisiana’s recently approved $50 billion coastal master plan to plan for hurricane prevention and restoration projects. "If we could deliver the results with half the cost as the Louisiana program, we wouldn’t need those billions."

The Nature Conservancy’s marine scientists developed protocols for "reef first responders" to restore and manage damaged reefs, which reduces the amount of time a reef is left damaged and the coastline unprotected. The policyholder would have the funds necessary to quickly activate a team to restore the reef.

"A lot of hoteliers and local businesses understand inherently that the reef is protecting them, but heretofore there was no analysis that gets granular about the quantitative protection that the reef is providing to the coastal assets," said TNC’s Baughman McLeod.

Data is critical to the program's success, said Swiss Re's Kaplan. "Understanding how those reefs function in various scenarios is key to being able to underwrite exposure and being able to put insurance and reinsurance capital behind it."

Protecting paradise

One characteristic that made the Mesoamerican reef near Cancun a good place to test reef insurance is that the reef is already in good health.

"The idea is that you want to keep your asset healthy," said Baughman McLeod. "When there are stressors that are well-known around the world for ocean acidification, polluting and overfishing, protection is an essential element for keeping the reef healthy from stressors."

Rolling out an unusual new policy did rock the boat a bit throughout the local community.

"Our interest is in changing the way people see these natural assets and finding ways to protect them with science and with funding," she said. "The challenge is to help people see how reef and beach insurance can become a mainstream product for communities that are dependent on natural resources."

Historically, the insurance industry has played a silent role in influencing society’s behavior. For example, at the turn of the century, fast-growing cities constantly were rebuilding due to rampant urban fires. The insurance industry refused to underwrite new building projects unless they came with a fire escape, fire hydrant or extinguisher and an alarm system. The industry applied the same logic to forcing car manufacturers to install seat belts due to a rise in automobile injuries.

"Because you’re assigning a value to the reef, you know the various scenarios in which that reef can fail, and now you have a whole cast of stakeholders contributing to its future protection," said Kaplan. "It wasn’t until you started insuring your home that you thought about the risk reductive value of [a smoke detector]."

Once they finish their work in the Mesoamerican reef, the Nature Conservancy and Swiss Re plan to scale ecosystem insurance to other countries around the world where natural assets such as oyster beds, mangroves and wetlands provide business benefits and natural disaster protection, like the mid-Atlantic region in the U.S., where wetlands reduced Hurricane Sandy losses by upwards of $650 million.

|

|

|

|

Copyright remains with the original authors |