|

| Reviews and Templates for Expression We |

Investor Group Pressures Fossil Fuel Companies to Calculate Climate Risk

A group of 70 investors with more than $3 trillion of collective assets under management is pressuring fossil fuel companies to calculate the financial risks that climate change poses to their business plans.

A group of 70 investors with more than $3 trillion of collective assets under management is pressuring fossil fuel companies to calculate the financial risks that climate change poses to their business plans.The investor campaign, called the Carbon Asset Risk initiative, sent letters to 45 of the world’s top oil and gas, coal and electric power companies requesting they share the information by their 2014 shareholder meetings.

The group, which includes California’s two largest public pension funds, says it wants to understand each click to enlargecompany’s reserve exposure to the risks associated with current and probable future policies for reducing greenhouse gas emissions by 80 percent by 2050.

The CAR initiative — coordinated by Ceres and the Carbon Tracker initiative with support from the Global Investor Coalition on Climate Change — aims to persuade fossil fuel companies to reduce the carbon intensity of their assets, divest their most carbon intensive assets and diversify their businesses by investing in lower carbon energy sources.

Fossil fuel companies that don’t diversify and hold large amounts of unburnable carbon resources could see their stock price plummet, and in turn, hurt the value of investment portfolios that hold the shares, investors say.

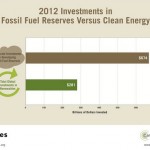

The 200 largest publicly traded fossil fuel companies collectively spent an estimated $674 billion in 2012 on finding and developing new reserves, some of which may never be used, according to the Unburnable Carbon report. The investor initiative says it’s trying to show companies the opportunity to redirect this capital, rather than waste it on high carbon assets that could become stranded.

A briefing released in July by the United Nations Environment Programme Finance Initiative and a group of investors including Allianz, HSBC, Pax World Investments and Trillium Asset Management urged institutional investors to start measuring, disclosing and reducing greenhouse gas emissions associated with their investments and portfolios to reduce policy, regulatory and financial risks associated with these emissions.

The briefing says that carbon footprinting is one of several key tools that investors should use to understand, assess and mitigate portfolio carbon risk.

|

|

|

|

Copyright 2011 Energy and Technical Services Ltd. All Rights Reserved. Energyts.com |